In 2015, there were about five lakh road accidents in India, which killed about 1.5 lakh people and injured about five lakh people. India, as a signatory to the Brasilia declaration, intends to reduce road accidents and traffic fatalities by 50% by 2022. The Motor Vehicles (Amendment) Bill, 2016 has been listed for consideration and passage in the current Budget Session of Parliament. It seeks to address issues related to road accidents, third-party insurance and road safety measures. In this context, we present some data on road accidents, causes of accidents, and motor vehicle third party insurance.

| Since 2000, while road length has increased by 39%, the number of motor vehicles has increased by 158% | |

| | |

- Road length in India has increased from about 4 lakh kilometers in the 1950s to about 55 lakh kilometers in 2015. The majority of this growth has been in rural roads and roads constructed by the Public Works Department (PWD). Rural roads account for 61%, and PWD roads for 20% of the total road length. In comparison, urban roads have a 9% share in the road network. The growth in rural roads may be attributed to schemes such as the Pradhan Mantri Gram Sadak Yojana, which was launched in 2000 and aimed to improve road connectivity in rural areas.

- National Highways constitute 2%, and State Highways 3% of the total road length. Project Roads, account for 7% of the total road length, and include roads built by various state departments such as forest, irrigation, electricity, public sector undertakings such as Steel Authority of India, and the Border Roads Organisation.

Since 2000, while the road network in the country has grown by 39%, the number of registered vehicles has grown by about 158%. While growth in road networks will be limited (due to physical constraints), a constant increase in the number of vehicles on roads may lead to congestion and road fatalities.

National Highways comprise 2% of the total road network, but witness 28% of the road accidents

| | · While highways (both national and state) comprise about 5% of the total road network, they witness 52% of the accidents. More accidents on highways may be attributed to higher vehicle speeds and higher volume of traffic on these roads. · Road standards, construction, and maintenance are determined by the authority under whose jurisdiction the road falls. Various expert committees have noted that the responsibility for road safety is diffused across various bodies, and there is no effective coordination mechanism between these bodies. |

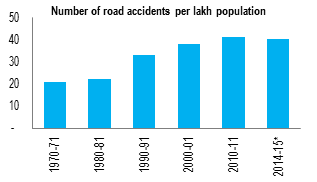

Accidents per capita are increasing; Goa and Kerala have most share of accidents per lakh population

* While each bar represents decadal data, the 2014-15 data is only half way through the decade.

- The number of road accidents per lakh population has been increasing since the 1970s, with an 84% increase from 1980 to 1990.

- Across states, Goa had the maximum share in total road accidents/ lakh population in 2015 for the fourth year in a row (222 accidents/ lakh persons). This was followed by Kerala (110 accidents/ lakh persons), and Tamil Nadu (100 accidents/ lakh persons).

In terms of accident fatalities, Tamil Nadu had the highest share in 2015 (23 fatalities/ lakh persons) followed by Haryana (18 fatalities/ lakh persons), and Karnataka (18 fatalities/ lakh persons).

| Number of road accidents/ lakh population | Number of persons killed in road accidents/ lakh population |

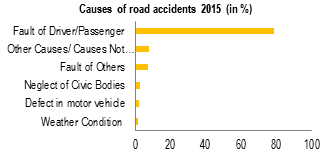

Drivers are held responsible for 78% of accidents; 3% accidents are caused by neglect of civic bodies

- The majority of accidents (78.4%) are caused due to the driver’s fault. This includes overspeeding, driving under the influence of alcohol or drugs, and hit and run cases.

Other causes of road accidents include fault of others (7.1%) such as fault of cyclists, pedestrians or drivers of other vehicles. Fewer accidents are caused due to neglect of civic bodies (2.8%), defect in motor vehicle (2.3%), and poor weather conditions (1.7%).

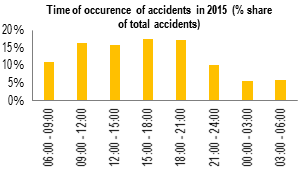

67% road accidents take place between 9AM and 9PM; 18-34 year olds most affected

- In 2015, 17.5% of all road accidents occurred between 15:00 hours and 18:00 hours, followed by 17.3% between 18:00 hours to 21:00 hours. This may be attributed to more vehicles present on roads during these hours (peak traffic hours).

- In 2015, the maximum number of fatalities were seen in the age group of 18 to 34 (50%), followed by the age group of 35-64 years (36%).

The World Health Organization has noted that road accidents are a major public health problem as crashes kill more than 1.25 million people and injure about 50 million people a year, with 90% of such casualties occurring in developing countries.

With unlimited liability, premium for third party insurance has been increasing rapidly

| | |

- One of the ways for accident victims to be compensated for road accidents is through motor vehicle insurance. Motor vehicle insurance has two parts: (i) own damage (OD) and (ii) third party liability (TP). While OD covers for the vehicle and its physical damage, TP provides for the injury or death of others involved in the accident. Under the Motor Vehicle Act, 1988, third-party insurance is compulsory for all motor vehicles.

- Between 2009 and 2014, while premium earned through OD segment has increased by 93%, the premium earned through TP has increased by 248%. The share of TP within total motor accident premium earned has increased from 38% in 2009 to 52% in 2014.

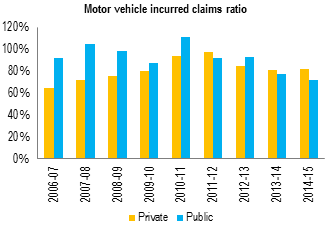

Incurred claims ratio for motor insurance is high; claims ratio for private companies has been increasing

Data Sources: Ministry of Road Transport and Highways; Ministry of Statistics and Programme Implementation; Insurance Regulatory and Development Authority of India; PRS.

Map visualizations have been made using SocialCops.

- The incurred claims on motor insurance business ranged between 84% and 103% of the net premium earned between 2006-07 and 2014-15. This ratio for private motor insurance companies has increased from 64% in 2006-07 to 82% in 2014-15.

- Currently, third-party insurance has unlimited liability which means that the insurer has to cover the entire amount of compensation as decided by the courts. Compensation amounts are calculated by courts on the basis of several factors such as age, and earning capability of the victim, and may go up to several crore rupees. With unlimited liability, and compensation amounts increasing, claims being paid by insurance companies have been increasing. Consequently, insurance premiums are being increased regularly.

DISCLAIMER: This document is being furnished to you for your information. You may choose to reproduce or redistribute this report for non-commercial purposes in part or in full to any other person with due acknowledgment of PRS Legislative Research (“PRS”). The opinions expressed herein are entirely those of the author(s). PRS makes every effort to use reliable and comprehensive information, but PRS does not represent that the contents of the report are accurate or complete. PRS is an independent, not-for-profit group. This document has been prepared without regard to the objectives or opinions of those who may receive it.